For the next 4 weeks, we will be doing a short course in accounting ran by Angela and Carolyn from the business department at college. The official title for the qualification is “AAT Level 2 Award in Accounting Skills to Run Your Business”.

Below is a write up of the notes, I took in this meeting/lecture.

The two most common types of self employed business are; Soletrader and Limited (LTD).

The basics of being a Soletrader are that:

- You are the owner

- You control who your clients are

- You choose your hours

- You choose where you work from

- You can claim tax on mileage and also on working from home

- You are able to employ others

However the negative affects of this are:

- The business is all on you, so if you go under you’re liable and therefore screwed

- Individual (myself) is liable for all the debt that the company is in

- There are additional costs for employing staff. These include wages, national insurance and also the cost to employ and train staff

The basics of being a Limited business (LTD) are that:

- The company is owned by shareholders, not just the company owner

- This creates a protection fence as then you are not fully liable for the debt of the company if it goes under

- You will only lose what you put in

- You can still hire employees

- You aren’t quite as flexible as you can’t fully dictate your hours and workspace

Tax:

- The Tax year runs from 6th April – 5th April

- A Soletrader will need to complete a Self Assessment by 31st January each year

- You must keep hold of all invoices on the company in order to complete the self assessment and also claim the right amount of tax each year

- This is also crucial as banks ask for 3 years worth of statements and invoices when applying for a loan or mortgage

- You can claim up to 5 years worth of invoices in order to “balance the books” at the end of each year

- You’ll most likely find that the first two years in business will generate no profit

- A Limited company must complete a Self Assessment by 31st January, send copies of their accounts to HMRC and Companies House, and finally complete a Corporation Tax Return

Banking as a businessman:

As a Soletrader, you are in charge of your own money. This means that you can put all of your money into your personal account. It also means that you can do what you want with the money as long as you make sure you don’t go short as you have wasted too much on non-business expenditure. However as the Taxman decides to question every single transaction that you make; its better to open a current account in the business name in order to protect the money and your own personal bank account from the Taxman.

As a Limited company, the money is held in a specific company bank account that is not available to be accessed at any time. Paying in and withdrawing money in order to pay for supplies and wages etc can only be done through making dividends. By paying in and withdrawing this way, the first £5000 is tax free.

Other Notes from the lesson:

- Dead Money – This is when you are waiting for payment from your clients. For instance, in my chosen field of Theatre in Education I will be dealing a lot with schools who tend to have a 30 day payment term. This means that I will be awaiting payment until up to 30 days after the performance and workshop has taken place. The way to get around this is to have a booking fee/ deposit of around 20%. This makes sure that there is money coming in even whilst waiting for the final payments from schools/ clients. This won’t be so much of a problem in the storytelling side of the business as fayre’s and fun days pay cash in hand at the end of the event.

- The college’s payment policy is that if the invoice is put in on the 1st of February then payment will be on the 31st of March. However if the invoice is put in on 31st of January, then payment will be on 28th February.

- Branding – One of the key ways to establish a business is through advertising and branding. For a T.I.E company, having t-shirts for the company and badges or stickers for the children is a great way to gain public interest and spread the word through schools, teachers and parents.

- Its always useful to ask for VAT receipts as then you can claim back mileage, fuel and entertaining clients.

Week 1 Booklet:

How will this help my development?

Although this was the first session, I can already see that Accounting is going to be invaluable for me. This is because it is another skill that I will learn on the Level 4 course that many never have the opportunity to do. Also, if my business does become legitimate in the next few years, I will have practice in accounting skills and therefore will not need to spend more time looking at this. Whereas competitors would have to allocate time to go through all of these skills when setting their business up.

How this has helped at the end of the project?

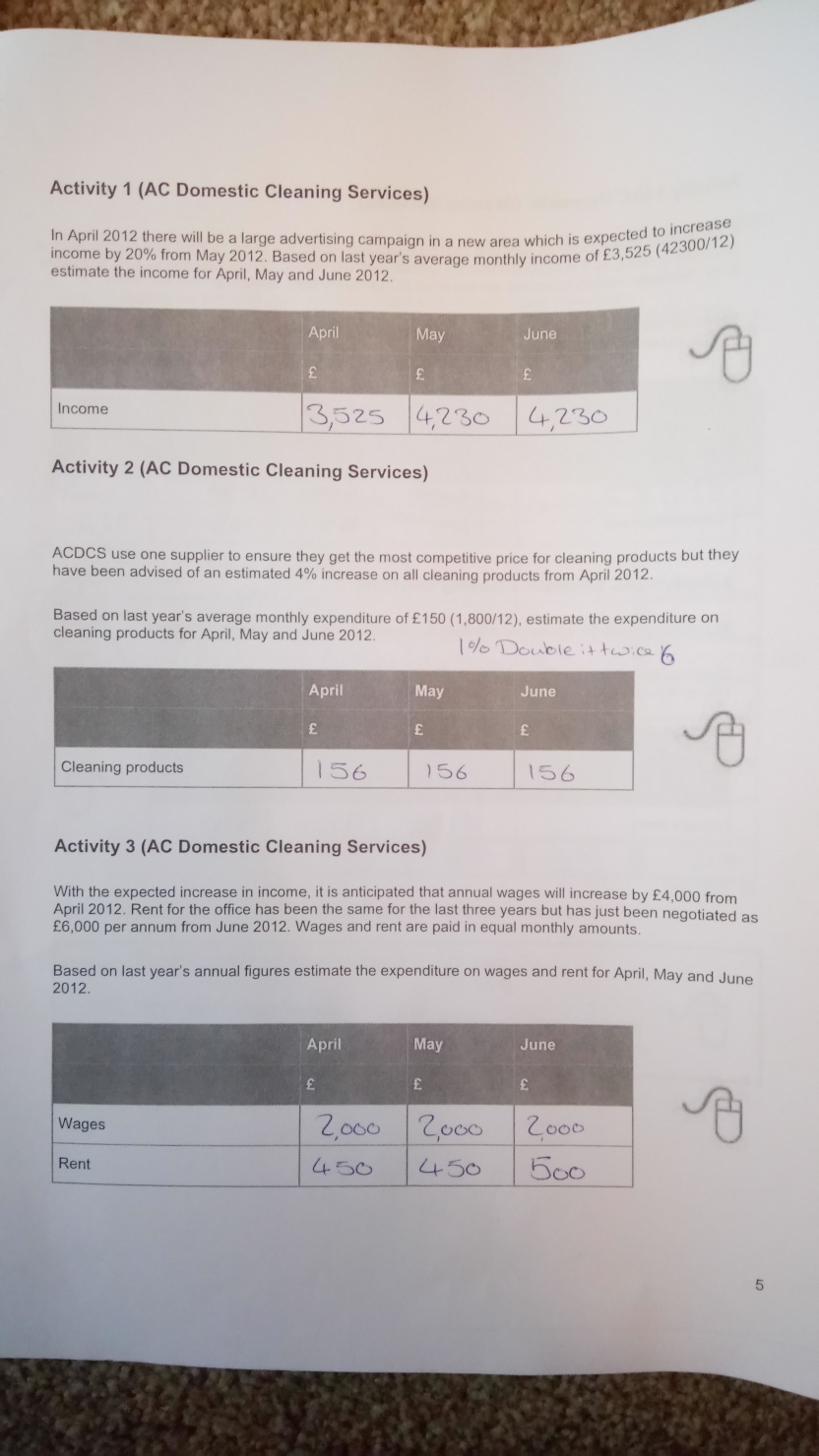

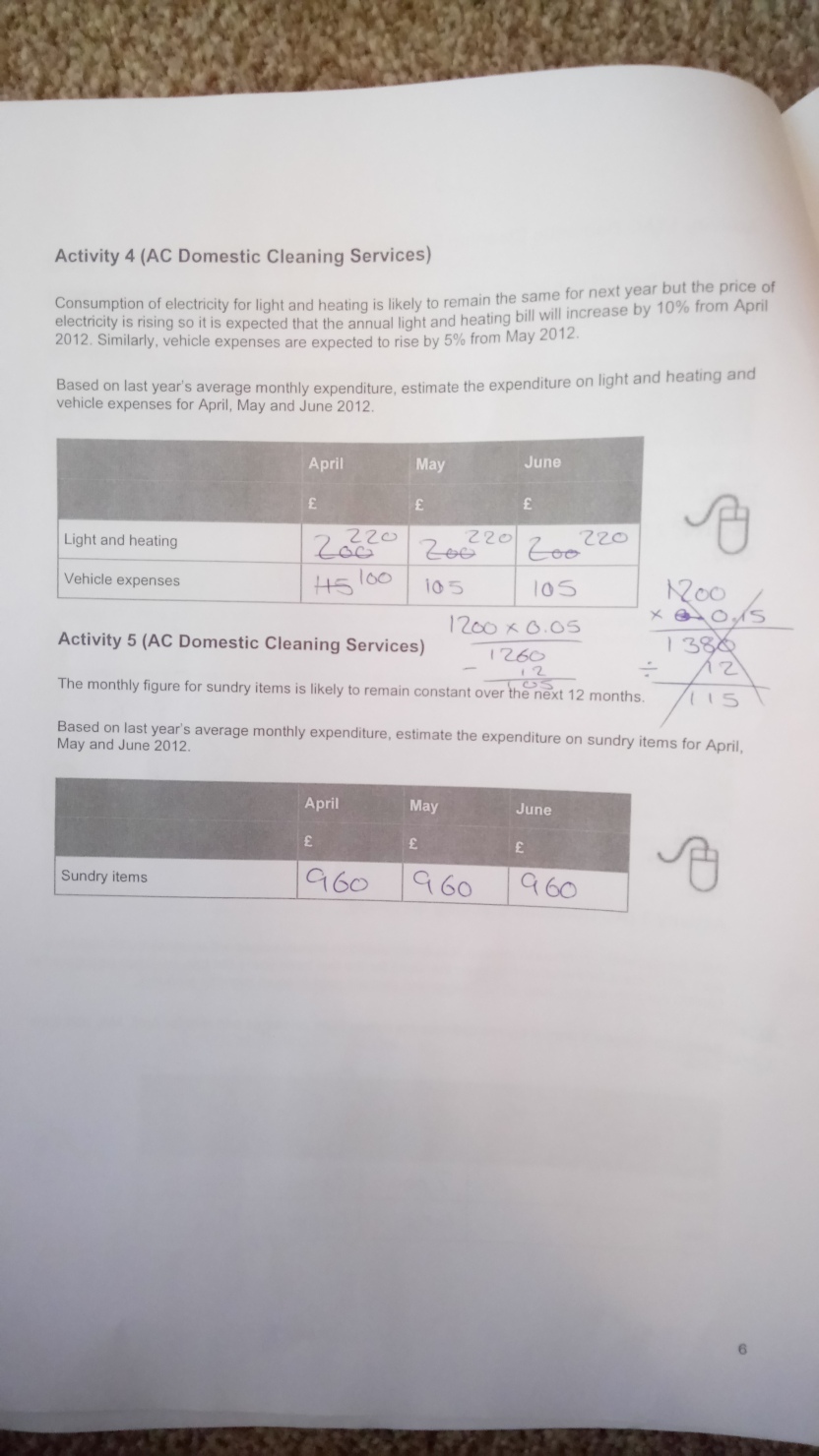

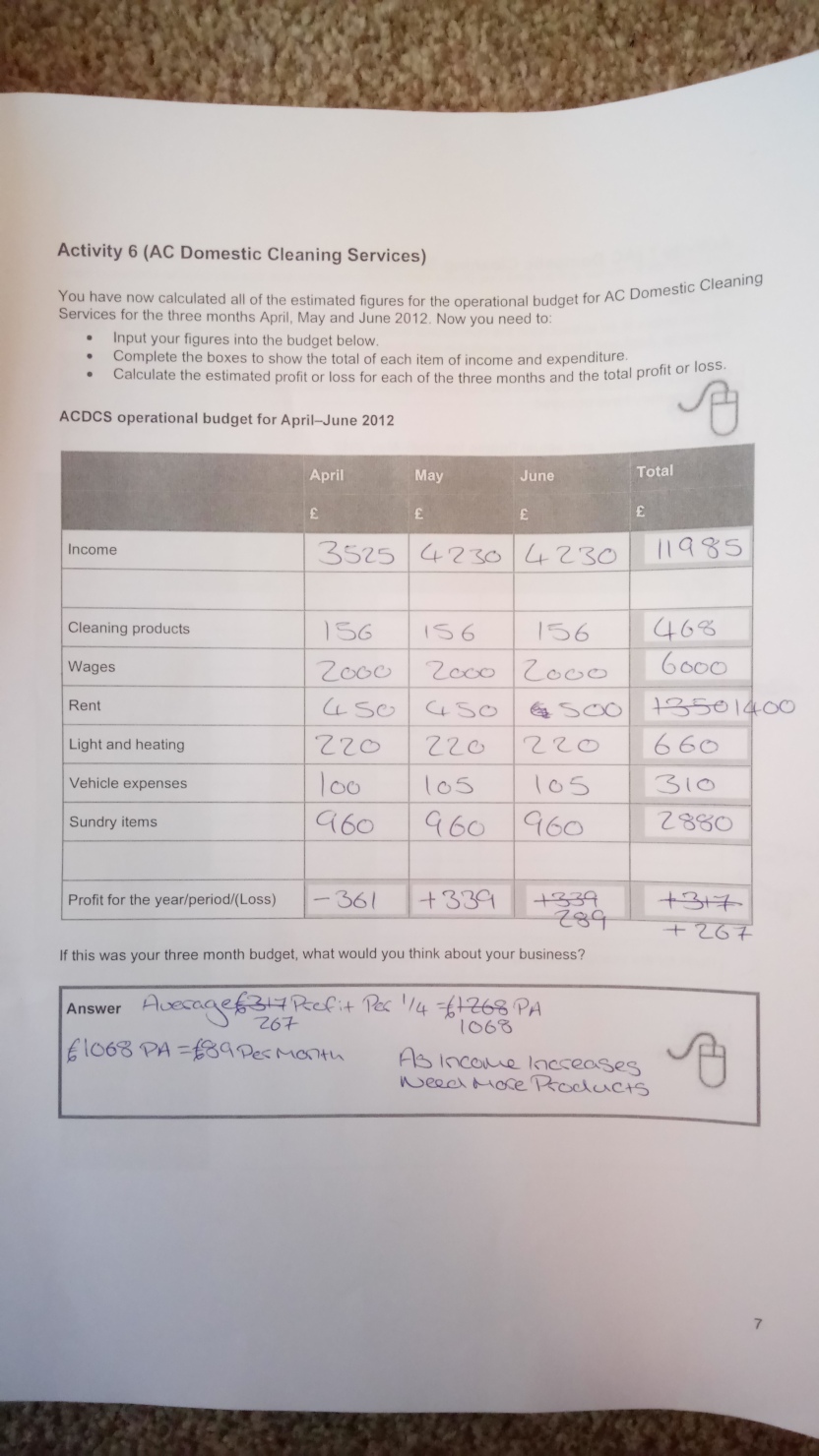

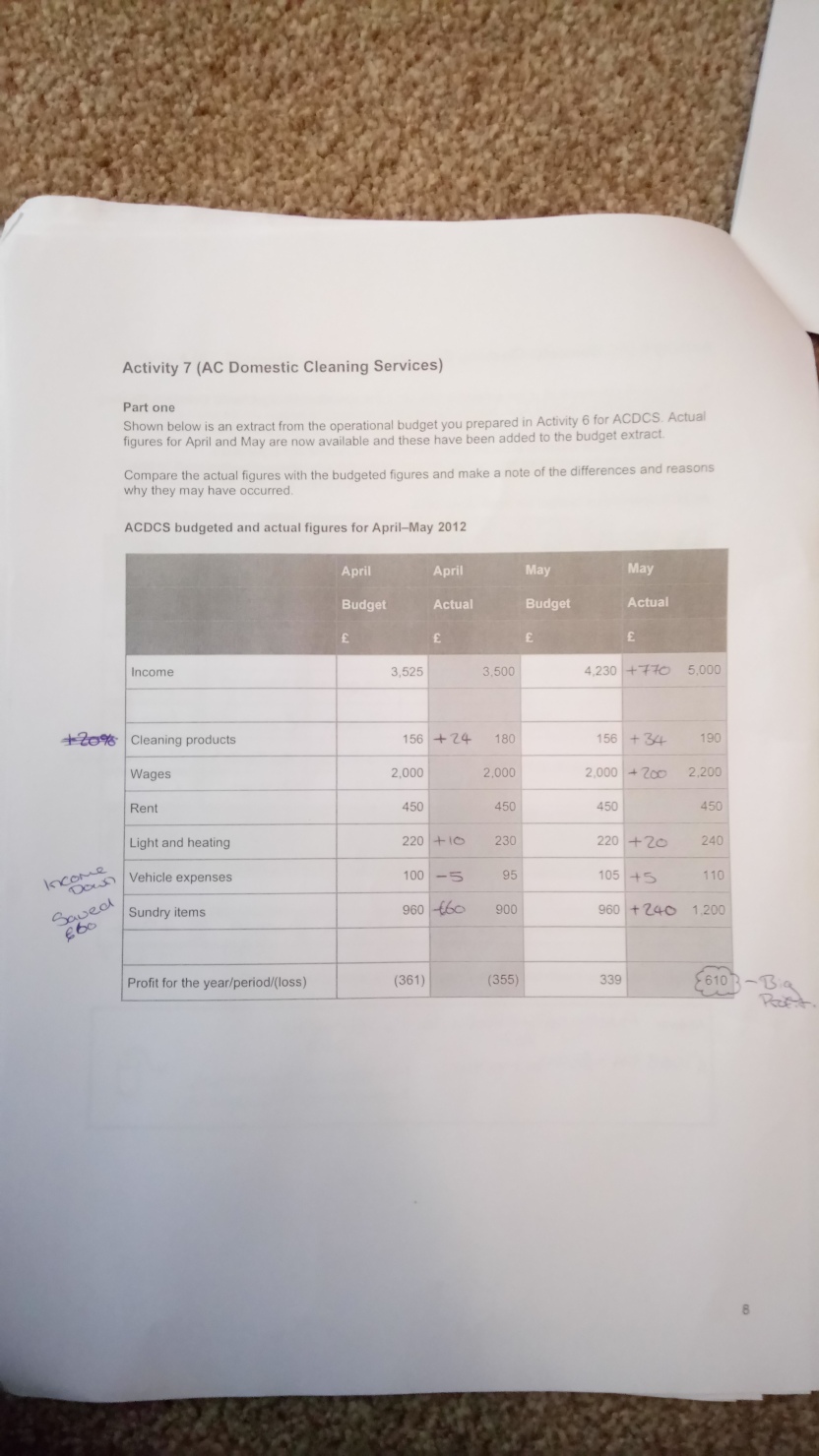

Looking at creating a budget has helped me in the final stages as it has allowed me to see the sort of things – wages, marketing, sundry items etc – that I will need to budget for. This has helped with my business set up costs and also when I was creating a cash flow summary as I returned to this page and saw what sort of things my money going out of the business was going to be used for each quarter.

Well done Jack, this is a really good record/notes of what you covered in this lesson. If you keep working to this level of detail you will have a thorough understanding of all the elements which need to go into your business plan. Well done!

LikeLike